The Graphite Electrodes market in the U.S. is estimated at US$1.6 Billion in the year 2021. China, the world`s second largest economy, is forecast to reach a projected market size of US$2.5 Billion by the year 2026 trailing a CAGR of 6.2% over the analysis period. Among the other noteworthy geographic markets are Japan and Canada, each forecast to grow at 3.6% and 3.9% respectively over the analysis period. Within Europe, Germany is forecast to grow at approximately 4.6% CAGR.

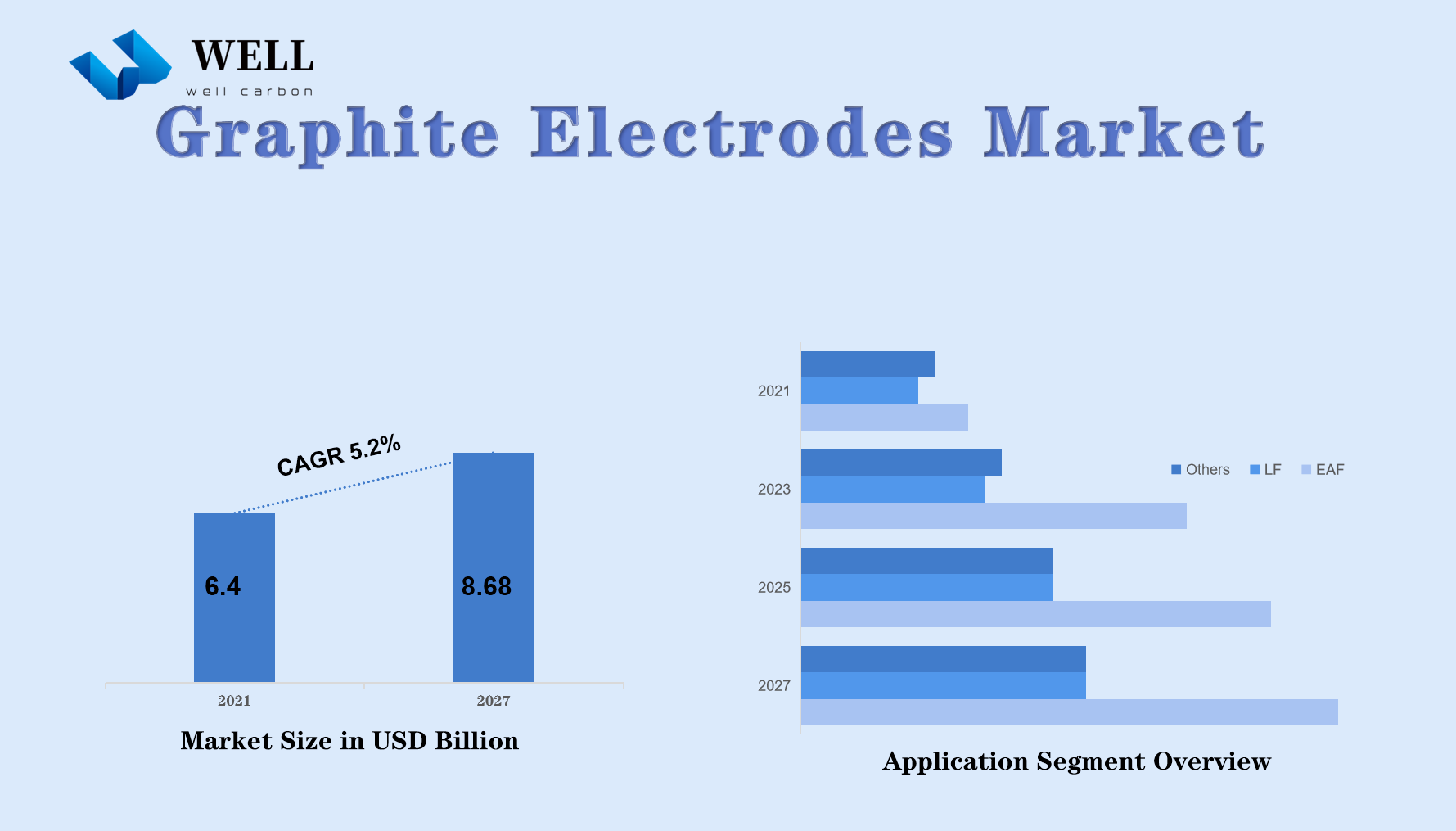

The market is expected to gain from increasing production of steel and iron across emerging countries along with easy access to steel scrap in China. The market is expected to also gain from increasing dependence of steel manufacturers on electric arc furnaces that use graphite electrodes during the melting process. On the other hand, rising needle coke prices are leading to supply bottlenecks, while factors including market consolidation and limited expansion of the ultra-high power (UHP) graphite electrode market in China are likely to restrain the market growth. Ultra-high power (UHP) graphite electrodes represent the most popular product type in the global graphite electrodes market that is estimated to post a healthy growth in the coming years. These products are anticipated to witness high demand owing to their superior properties such as high durability and thermal resistance along with excellent electrical and thermal conductivity. In addition to finding use in DC and AC electric furnaces, UHP graphite electrodes are widely employed in the steel scrap melting process to expedite production.

China holds the leading share of the production and consumption of graphite electrodes in the region and globally. While focus on high specifications and rising environmental concerns are pushing capacity additions in the Chinese EAF steelmaking industry, rising consumption of graphite electrodes in lithium batteries is driving the demand for needle coke in the country. In addition, anticipated increasing domestic use is expected to fuel graphite electrode demand in China. The graphite electrodes market in China is expected to gain from increasing dependence of the steel industry on EAF technology along with use of made-in-China electrodes. Recent policy mandates across various provinces including Beijing are coercing steel manufacturers to shut down an estimated capacity of around 1.25 million tons. The domestic demand is likely to be further propelled by increasing automobile production and rising residential construction activity, creating the need for steel, iron and non-ferrous alloys. In addition, China is investing to double the production capacity of ultra-high power (UHP) graphite electrodes in the coming years.